As the world faces mounting challenges from resource depletion and waste, the circular economy offers a transformative solution. IFC is supporting private clients in their ambitions to scale solutions that design out waste, keep materials in use, and regenerate natural systems — creating jobs, strengthening business resilience, and driving growth.

What is the Circular Economy?

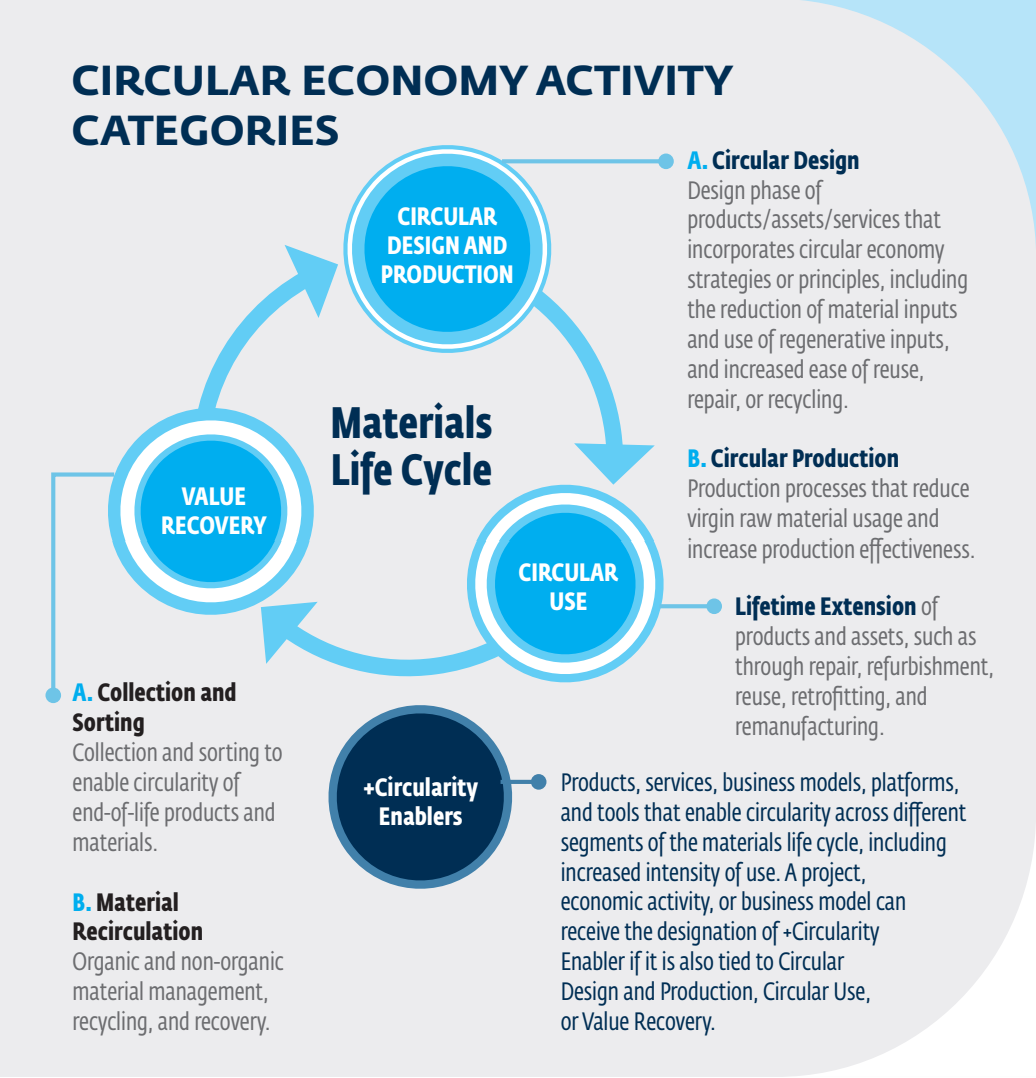

The circular economy replaces the linear “take-make-waste" model with systems that design out waste and pollution, keep products and materials in use, and recover and recirculate materials. By reducing material inputs, circularity can strengthen business resilience while enabling innovative models such as reuse and refill, repair, remanufacturing, and product-as-a-service.

How is IFC Advancing Circular Economy Finance?

IFC is helping scale circular solutions and accelerate investment in emerging markets, including through:

Supporting Circular Businesses

- Financing companies in manufacturing, infrastructure, agribusiness, and consumer goods that integrate circular practices.

- Advising clients on product redesign, waste reduction, and circular supply chains.

Setting Global Standards

- Developing frameworks and tools, such as the Harmonized Circular Economy Finance Guidelines, to define and measure circular investments.

- Supporting sector-specific guidance and global taxonomies to align financial flows with circular objectives.

Enabling Market Action

- Tracking circular economy investments through tools like the Circular Economy Investment Tracker.

- Partnering with organizations to mobilize blended finance for plastic transition and other circular initiatives.

Driving Systemic Change

- Working with countries to align stakeholder activities, boost demand for recycled materials, and strengthen capacities of recyclers, manufacturers, and waste management systems.

- Providing financing and advisory support to scale circular economy solutions.

Why Circular Economy Matters

- Job Creation: Can create new employment opportunities across the full circularity lifecycle, particularly in manufacturing, agribusiness, infrastructure development, and innovative service models.

- Business Resilience: Reducing inputs can generate cost savings for businesses and strengthen their supply chain resilience through sustainable alternative materials.

- SMEs & Entrepreneurship: Circular activities like repair, refurbishment, and recycling can create business opportunities for SMEs, with growing sectors such as electronics repair and textile upcycling driving entrepreneurship.

- Environmental Impact: By reducing material use and waste, circular practices can lower emissions, cut pollution, and ease pressure on natural systems.

Scaling Circular Solutions Across Emerging Markets

Since 2015, IFC has invested more than $1.9 billion and mobilized nearly $500 million in projects that support circular solutions in emerging markets. These projects span the full circularity lifecycle: from design and production to circular use and value recovery.

IFC’s portfolio includes financing for manufacturers integrating recycled materials into production, consumer goods companies shifting to reusable or refillable packaging, and infrastructure projects that enable reintegration of resources into the supply chain.

IFC’s investments in the circular economy (since 2015):

-

67 investments made

-

35 countries covered

-

$1.9+ billion in own account financing committed, excluding investments in financial Institutions

-

$480+ million financing mobilized

Disclaimer: Estimate based on application of the Harmonized Circular Economy Guidelines and latest available information as of September 2025.

Press Releases

More press releasesLast updated: October 2025