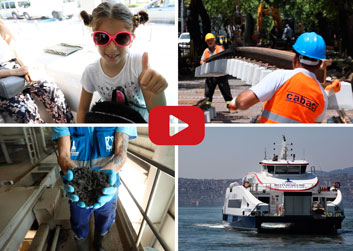

IFC is working with the Turkish municipality of Izmir on a series of projects—including tram lines—to meet the city’s long-term needs. © Dominic Chavez/IFC

| This story is part of a series on IFC’s work to help create markets that give new opportunities to people in developing countries. These innovative approaches have helped solve some of the largest problems in countries or, sometimes, entire regions. |

By Vanessa Bauza, IFC Communications Officer

By Vanessa Bauza, IFC Communications Officer

Livable. Ask residents of Izmir, Turkey’s third-largest metropolis, to describe their city and that’s the word that comes up again and again. Built along the Aegean Sea, Izmir has been home to a melting pot of cultures for more than 3,000 years.

But what makes Izmir “livable?” It’s the ferries that crisscross the Gulf of Izmir, offering a commute so scenic that even locals can’t resist a selfie. The cycling lanes and bike share stations that allow people to pedal to their errands. The seaside promenade that draws fishermen and families alike as the sun sets across the water. And the tram lines that just opened and will soon run along both sides of the gulf, like a ribbon wrapped around 22 kilometers of coastline.

A generation ago, the gulf was clogged and an acrid odor swept up from the port. Today, the gulf is cleaner, the pungent smell is gone, and the city of 4 million people is investing in an ambitious plan that aims to reduce carbon emissions in public transportation by 20 percent.

To help Izmir unlock new sources of international financing to meet the city’s expanding infrastructure needs, IFC and the municipality began a strategic relationship in 2011. Since then, IFC has provided $500 million—including funds mobilized from other investors—in financing for nine infrastructure projects, mainly in public transportation.

IFC’s work includes financing the new tram lines, a smart traffic-management system that is reducing congestion by 25 percent, and the purchase of 85 new subway cars. IFC supported a new wastewater treatment plant in an underserved part of town, helping to raise the plant’s environmental standards and find solutions to manage municipal waste.

The success of IFC’s investments has effectively created a new market for infrastructure financing to meet Izmir’s long-term needs. A decade ago, only 30 percent of the city’s funds for infrastructure and other improvements came from international sources. Today, more than 75 percent of its financing does. Izmir also received a triple-A credit rating for local-currency lending, sending a signal of confidence to investors.

The Challenges of Cities

Turkey offers a view into the challenges and opportunities of urbanization. In 1950, its economy was largely agrarian: 75 percent of its people lived in rural areas. Today, 75 percent live in cities. This has benefits.

“No country has achieved middle-income status without becoming largely urban,” says Tomasz Telma, IFC Director for Europe and Central Asia. “That’s because cities are central to economic growth, generating jobs and producing more than 80 percent of the world’s gross domestic product. And cities are often laboratories of innovation—testing grounds for policies and solutions that can be scaled up at national levels.”

But fast growth brings challenges. For instance, cities—which are growing by about 65 million people a year—generate 70 percent of global carbon emissions.

Recognizing the need for investment in municipal infrastructure, IFC has provided more than $10 billion in financing for 300 urban projects and provided advisory services to cities in more than 60 countries over the past decade. Already IFC has established strategic relationships with 10 cities—Bogota, Buenos Aires, Belgrade, Izmir, Istanbul, Antalya, Kigali, Cape Town, Durban, and Bhubaneswar—and aims to expand this work. The idea is to move beyond individual transactions and help to create markets for private investment in urban infrastructure.

For instance, in Bhubaneswar, capital of India’s Odisha state, IFC has helped attract $250 million in private investment for a range of projects that will generate rooftop solar power, refurbish four hospitals, and increase affordable housing. With IFC’s support, the city has also retrofitted nearly 20,000 streetlights with energy-efficient bulbs, leading to an 80-percent decline in energy consumption.

And the city of Belgrade is working with IFC on a plan to generate energy from organic waste and retrofit outdated and inefficient heating systems to make them more energy-efficient.

Cities’ needs are not limited to financing. As they grow, municipal governments need to broaden their sources of financing, moving beyond traditional public funding to tap much larger pools of private savings. IFC has offered training for representatives of 12 Turkish municipalities to address potential risks related to project financing such as exchange-rate fluctuations and currency mismatches between municipal revenues and debt-service obligations.

Another challenge is that only 5 percent of the world’s 500 largest emerging-market cities are deemed creditworthy, limiting their access to capital markets. In collaboration with the World Bank, IFC is helping cities such as Belgrade, Johannesburg, and Antalya improve their creditworthiness. This helps cities leverage private investment for large-scale infrastructure projects that they might not be able to fund on their own.

A Brighter Future Ahead

In Izmir, as the city continues to grow, leaders embrace their rich past while embarking on an ambitious plan to further advance sustainable development. For Mayor Aziz Kocaoğlu, it’s all about adapting to urban growth while maintaining a high standard of living and protecting the environment.

“I have a big project: a bay where people can swim,” Kocaoğlu says. “Seventy years ago, people were able to swim in this bay. I want to recreate that clean bay.”

To learn more about IFC’s work with municipalities, visit www.ifc.org/cities

This story is also available in Spanish.

Follow the conversation: #IFCmarkets

Published in June 2017