Washington, D.C., Thursday, November 30, 2023— IFC has recognized top performers for the 2023 Climate Assessment for Financial Institutions (CAFI) Awards for Climate Reporting, acknowledging IFC clients using the CAFI tool to report on their climate investments and commitments in emerging markets.

As of June 2023, IFC has committed $15.2 billion to climate related projects through more than 210 emerging market financial institution partners, leveraging an additional $5.8 billion. The CAFI tool allows these partners to assess the climate eligibility and climate impact of investments they make.

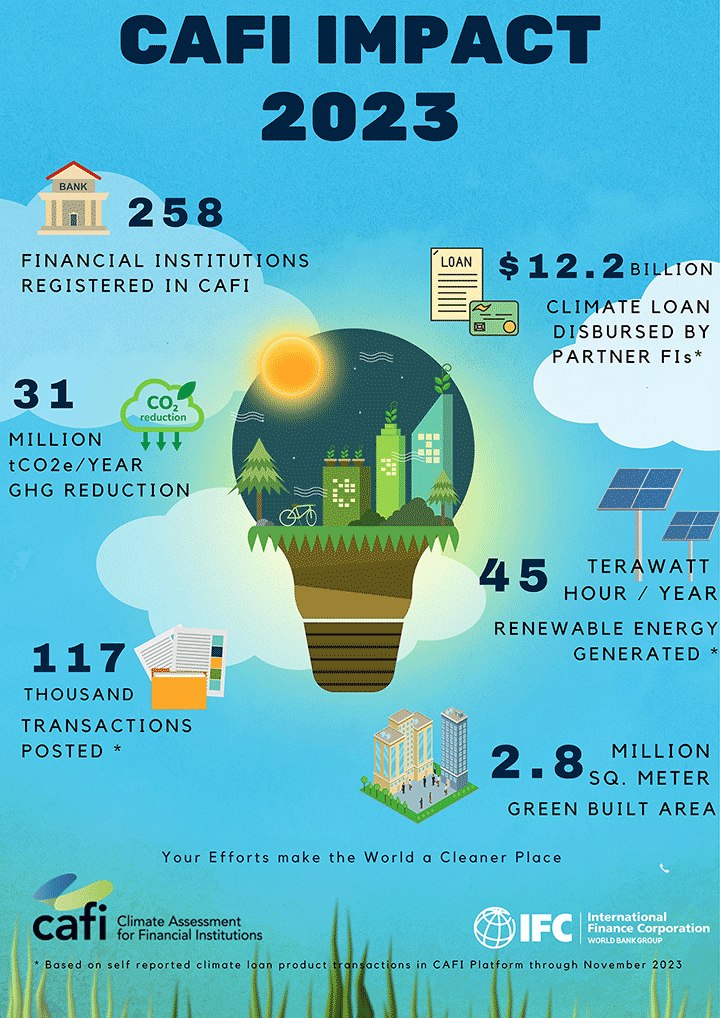

IFC clients have used CAFI to report more than $12 billion worth of climate loans disbursed in emerging markets, financing everything from large scale solar plants to climate smart agriculture projects for smallholder farmers. On an annual basis, these loans will reduce greenhouse gas emissions by more than 31 million tons; generate 45 terawatt hours of renewable energy; and finance 2.8 million square meters of certified green buildings, among other impacts. This reflects a considerable increase in the use of CAFI in recent years, and the continued importance of climate reporting across the financial sector.

IFC continues to invest in improvements to the tool, introducing new features like a link to IFC's EDGE tool for green buildings, improved methodologies for assessing eligibility, and impact calculations that are in line with the most recent principles for climate finance.

"CAFI continues to be a critical tool for accountability and progress in aligning financial flows toward the goals of the Paris Agreement, "said Tomasz Telma, Global Director, Financial Institution Group, IFC. "IFC's work with banks and other financial institutions helps scale up climate finance activities and measure investments earmarked for climate, vital for our clients to realize their climate impact,"

This year's top global reporting financial institutions are:

- Most Transactions Reported: Equity Bank, Kenya

- Highest Climate Loan Amount Reported: Federal Bank, India

- Most GHG Mitigated: Federal Bank, India

- Best Achievement vs Climate Targets: Banco de la Producción, Ecuador

Top performers in each of IFC's regions have also been recognized for addressing climate change by investing in and measuring the impact of their climate projects.

FY23 Regional Award Winners:

| Africa | Award | Country |

| Equity Bank Limited | Most Transactions Reported | Kenya |

| Nedbank LTD | Highest Climate Loan Amount Reported | South Africa |

| Nedbank LTD | Most GHG Mitigated | South Africa |

| First Rand Bank LTD | Best Achievement vs Climate Targets | South Africa |

| East Asia and the Pacific | ||

| Orient Commercial Joint Stock Bank | Most Transactions Reported | Vietnam |

| Orient Commercial Joint Stock Bank | Highest Climate Loan Amount Reported | Vietnam |

| Orient Commercial Joint Stock Bank | Most GHG Mitigated | Vietnam |

| Central Europe | ||

| UniCredit Leasing Corporation | Most Transactions Reported | Romania |

| UniCredit Leasing Corporation | Highest Climate Loan Amount Reported | Romania |

| Banca Transilvania S.A. | Most GHG Mitigated | Romania |

| UniCredit Leasing Corporation | Best Achievement vs Climate Targets | Romania |

| Latin America and the Caribbean | ||

| Banco Alfa de Investimento | Most Transactions Reported | Brazil |

| Banco Alfa de Investimento | Highest Climate Loan Amount Reported | Brazil |

| Banco Agrícola | Most GHG Mitigated | El Salvador |

| Banco de la Producción S.A. | Best Achievement vs Climate Targets | Ecuador |

| Middle East and Central Asia | ||

| Joint Stock Commercial Bank "Uzbek Industrial and Construction Bank" | Most Transactions Reported | Uzbekistan |

| Joint Stock Commercial Bank "Uzbek Industrial and Construction Bank" | Highest Climate Loan Amount Reported | Uzbekistan |

| South Asia | ||

| Federal Bank Limited | Most Transactions Reported | India |

| Federal Bank Limited | Highest Climate Loan Amount Reported | India |

| Federal Bank Limited | Most GHG Mitigated | India |

| Federal Bank Limited | Best Achievement vs Climate Targets | India |

About IFC

IFC — a member of the World Bank Group — is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2023, IFC committed a record $43.7 billion to private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity as economies grapple with the impacts of global compounding crises. For more information, visit www.ifc.org.

Stay connected with IFC on social media.

About CAFI

IFC is committed to reducing emissions and protecting the most vulnerable communities against climate risks while building the capacity of the global financial sector to deploy more green financing. Using the Climate Assessment for Financial Institutions (CAFI) tool, financial institutions can verify whether a project meets internationally agreed-upon criteria for climate finance and ensure that climate metrics and eligibility criteria meet IFC's Definitions for Climate-Related Activities and the Common Principles for Climate Mitigation Finance Tracking. Our industry tools and resources create a unified understanding of what activities contribute to fighting climate change. The CAFI platform allows for reporting across a range of categories: adaptation, energy efficiency, green buildings, renewable energy, transport, water efficiency, and more. CAFI is managed by IFC with support from the UK government. The tool is available for use by any financial institution that invests at scale in climate friendly projects— multilateral developmentgree banks, international financial institutions, banks, fund managers. Organizations interested in accessing the platform can contact the CAFI team at cafi@ifc.org.

Contacts

Stay Informed

Sign up to have customizable news & updates sent to you.