© IFC

Within a decade, solar power could be the cheapest form of energy in India.

Within a decade, solar power could be the cheapest form of energy in India.

This forecast, from Inderpreet Wadhwa , founder and Chief Executive Officer of India’s Azure Power, would have been unthinkable seven years ago. Back then, the solar industry barely existed in the country, and solar power was at least three times more expensive than electricity generated from fossil fuels.

But thanks to a strong commitment from the Indian government—and early and sustained support from IFC—India’s future in solar energy is looking much brighter. Today millions of people are benefiting from low-cost, clean energy.

Workers inspect solar panels. © Azure Power

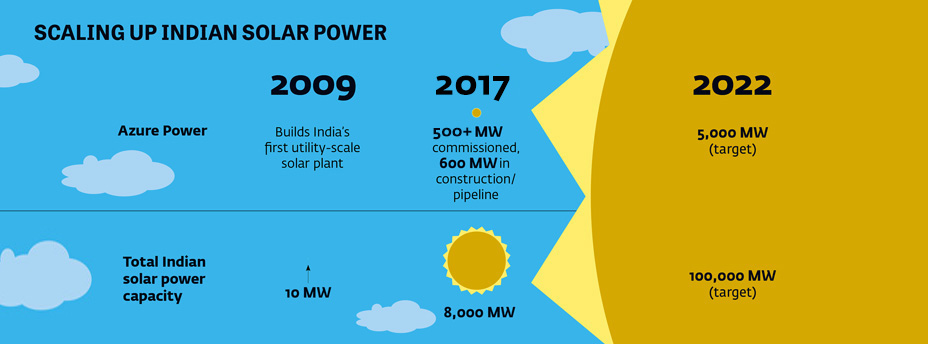

As one of the first solar power companies in the country, Azure Power played a catalytic role in building a market that is now thriving. Supported by a broad spectrum of financial products and services that IFC has brought to bear, the company’s capacity has grown exponentially, reaching 500 megawatts distributed in 25 plants and several commercial rooftop projects.

In October 2016, Azure Power became the first Indian renewable energy company to list on a U.S. Stock Exchange, and it now aims to reach an installed capacity of 5 gigawatts by 2020.

Through its growth, Azure Power has created more than 4,000 jobs—often in economically depressed areas such as Uttar Pradesh, one of India’s poorest states.

“We have created cash flows for communities and areas where you have wastelands, where there was no source of income,” said Wadhwa. “We have built roads, installed streetlights, electrified villages, and invested in education.”

Sustained Support

As Azure Power was getting started seven years ago, IFC opted to take a comprehensive approach. We saw that the company could be a pioneer in building a vibrant market for solar power in India.

Our first investment in Azure Power, a $10 million quasi-equity investment in 2009, was followed by equity investments with support from IFC Asset Management Company, which helped the company expand its operations significantly. IFC has also provided loans to three Azure projects using the proceeds of IFC’s Green Bond program, and mobilized $120 million from third-party investors.

IFC’s investments helped the company attract capital from other development finance institutions.

In 2013, the company got a boost when it won a competitive bid with the State of Gujarat to develop an innovative distributed-generation project using grid-connected rooftops.

Along the way, IFC helped strengthen Azure Power’s corporate governance and risk-management practices, and also introduced the company to institutional investors through the IFC Global Infrastructure Fund, a fund managed by IFC Asset Management Company. Through this fund, AMC made its first investment in India with Azure.

Ambitious Target

When Azure Power began operations in 2009, India had only 10 MW of installed solar generation capacity. Today, India has more than 8 gigawatts of installed capacity and is among the fastest growing markets in the world for solar power.

The growth of India’s clean-energy market has triggered significant price drops: power costs for Azure Power’s customers have fallen by 74 percent in the last five years, for example. This benefits customers and creates the right conditions for the country to meet its target of raising the installed capacity for solar energy to 100 GW by 2022.

With almost a quarter of its population still lacking access to electricity, India will need an estimated $250 billion in new investments to achieve that goal. Most of the funding will have to come from the private sector.

Over the past few years, IFC has provided debt finance to several solar companies and producers of renewable energy in general, including Sembcorp Green Infra Limited, Continuum Wind Energy, Ostro Energy, Acme Solar, and Inox Renewables. Overall, our funding contributed to the installation of 3 GW of different forms of renewable power projects in India. The latest investment, announced in January 2017, was in an equity stake in Hero Future Energies to support the expansion of its renewable energy operations.

IFC’s investments in the area are part of our broad commitment to support green growth and combat climate change. IFC is one of the largest renewable energy investors in the world and is working across sectors to promote energy efficiency and other climate-smart investments in emerging markets.

To learn more about IFC’s work in power, visit www.ifc.org/infrastructure

Stay connected: #6DecadesOfExperience

Published in January 2017