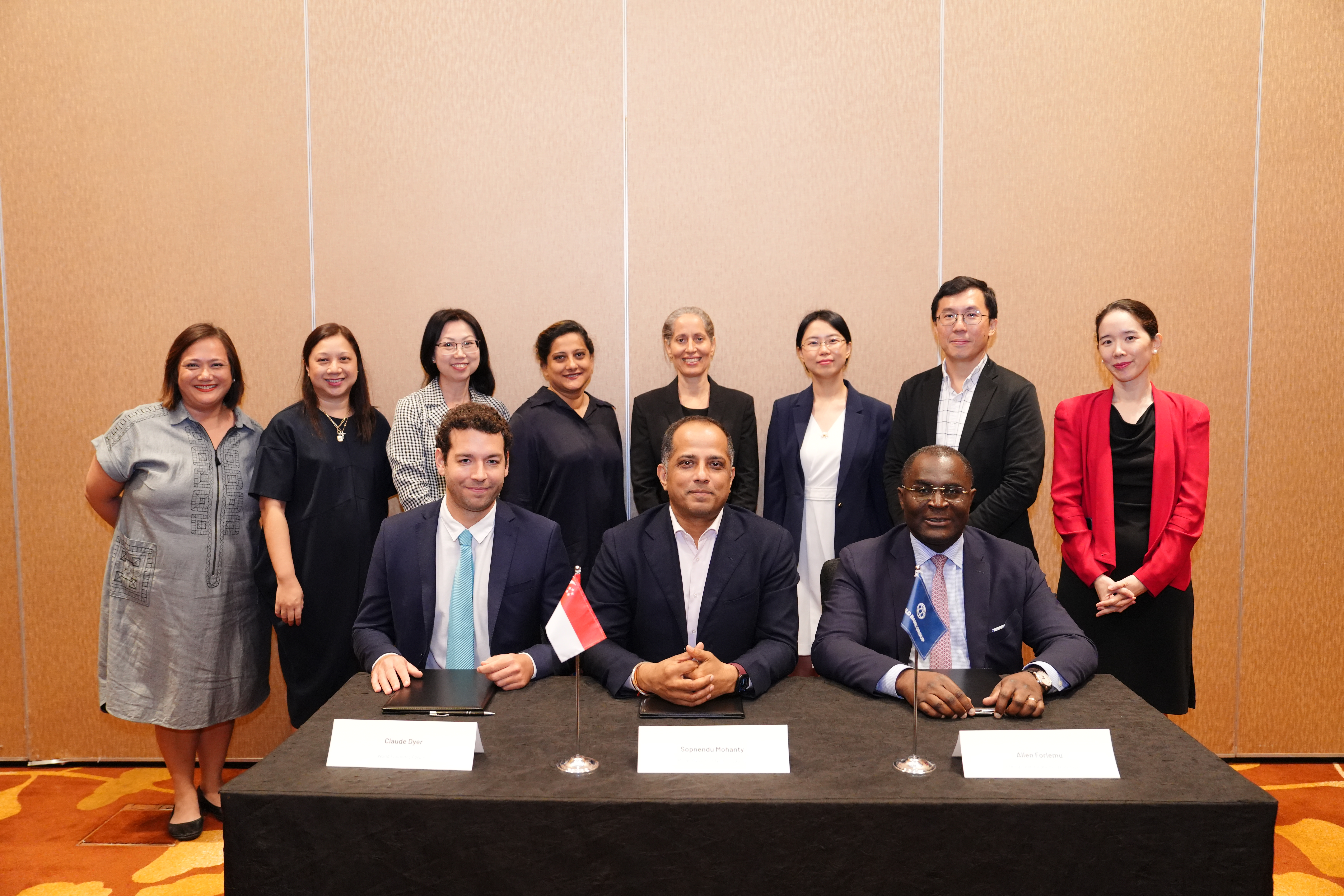

Singapore, 14 November 2023 – International Finance Corporation (IFC), Monetary Authority of Singapore (MAS) and World Economic Forum (the Forum) today signed a Memorandum of Understanding to collaborate on initiatives to advance digital inclusion[1] through financial services, with the aim of reducing inequalities for people and smaller businesses in emerging and developing economies.

The partnership will focus on finding ways to better mobilize financing to make digital services more affordable and accessible for underserved individuals and communities, and micro, small and medium-sized enterprises (MSMEs), with the support of financial institutions and FinTech companies. This will include creating guidelines for digital financial inclusion financing instruments[2] as well as efforts to promote the guidelines in the Asian market.

IFC, with its extensive network of financial institutions and financial-support mechanisms in emerging and developing markets, will drive the development of the guidelines, as a public knowledge piece, which may cover digital financial inclusion products, eligible assets, and measurement and reporting mechanisms. MAS will explore synergies with its other initiatives such as the SME Financial Empowerment and Financial Transparency Corridor Programs to improve financing access for MSMEs in emerging markets. The Forum will leverage its deep international network of government and private sector partners to promote and share these new solutions and learnings.

"The challenge to improve digital inclusion for billions of people in emerging and developing markets is significant, and traditional financing mechanisms alone cannot address this challenge," said Allen Forlemu, Regional Industry Director, Financial Institutions Group, Asia and the Pacific at IFC. "We need innovative financial instruments and guidelines to mobilise the trillions of dollars needed to improve digital inclusion. IFC is honoured to partner with MAS and the World Economic Forum to help address this challenge, which will ultimately benefit underserved people and businesses in countries that need it most."

"MAS is proud to partner the International Finance Corporation and the World Economic Forum to collaborate in research for digital inclusion, which could allow previously underserved individuals and MSMEs to access digital information, services, and products consistently and affordably. Through this partnership, we hope to promote developments in emerging markets, support quality education and reduce inequalities," said Sopnendu Mohanty, Chief FinTech Officer at MAS.

"In September 2021, the EDISON Alliance – the World Economic Forum's flagship initiative driving affordable and accessible digital services to underserved populations – released a 'Guidebook to Digital Inclusion Bond Financing', highlighting how innovative financing mechanisms can be used to advance digital inclusion globally," said Sebastian Buckup, Co-Head, Centre for the Fourth Industrial Revolution, and Member of the Executive Committee, World Economic Forum. "This timely partnership with IFC and MAS is vital to turning recommendations into actionable steps to channel financing towards digital public infrastructure, digital skills, and digital services for the underserved."

About Monetary Authority of Singapore

The Monetary Authority of Singapore (MAS) is Singapore's central bank and integrated financial regulator. As a central bank, MAS promotes sustained, non-inflationary economic growth through the conduct of monetary policy and close macroeconomic surveillance and analysis. It manages Singapore's exchange rate, official foreign reserves, and liquidity in the banking sector. As an integrated financial supervisor, MAS fosters a sound financial services sector through its prudential oversight of all financial institutions in Singapore – banks, insurers, capital market intermediaries, financial advisors, and financial market infrastructures. It is also responsible for well-functioning financial markets, sound conduct, and investor education. MAS also works with the financial industry to promote Singapore as a dynamic international financial centre. It facilitates the development of infrastructure, adoption of technology, and upgrading of skills in the financial industry.

About IFC

IFC — a member of the World Bank Group — is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2023, IFC committed a record $43.7 billion to private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity as economies grapple with the impacts of global compounding crises. For more information, visit www.ifc.org.

About World Economic Forum

The World Economic Forum, committed to improving the state of the world, is the International Organization for Public-Private Cooperation. The Forum engages the foremost political, business and other leaders of society to shape global, regional and industry agendas. (www.weforum.org).

[1] Digital inclusion refers to the use of safe and meaningful digital technologies to provide equal and affordable access to essential services for underserved people and businesses, including but not limited to finance, health, education and employment for individuals, and trade, markets, and financing for MSMEs, particularly those owned by women.

[2] An example could be a five-year digital inclusion bond, issued by a bank to support and empower a specified number of small businesses with access to e-commerce capabilities, online products, and digital educational resources.

Contacts

Stay Informed

Sign up to have customizable news & updates sent to you.