Bangkok, Thailand, July 5, 2023—To support job creation and strengthen economic inclusion in Thailand, IFC is providing a $105-million loan to Thai Credit Retail Bank Public Company Limited (Thai Credit), a bank focusing on micro, small, and medium enterprises (MSMEs) in Thailand.

Proceeds from the loan will be used to support MSMEs in Thailand, with at least 50 percent earmarked for women-owned or led MSMEs (WMSMEs). The funding will also help Thai Credit broaden its non-financial services (such as training on financing or networking) that are tailored towards WMSMEs.

Thai Credit has emerged as a key player in expanding access to financial services to nano and micro entrepreneurs and MSMEs, empowering those who have been historically overlooked. Through extensive outreach and strategic market presence, Thai Credit has helped bridge the gap among underserved entrepreneurs and provided them access to Thailand's formal banking sector.

"This collaboration is a testament of our shared commitment for greater financial inclusion and a testament of IFC's confidence in Thai Credit's social responsibility and business operations. Our core principle—Everyone Matters—underpins everything we do for our customers," said Winyou Chaiyawan, Chief Executive Officer of Thai Credit.

The growth engine of Thailand's economy, MSMEs represent 72 percent of the country's labor force and account for 35 percent of GDP. Access to finance has been challenging due to insufficient collateral, limited credit records, and perceived high business risk, among others. While MSMEs were the worst hit by the impacts of COVID-19, WMSMEs were disproportionately affected by the lockdowns.

"Thai Credit is pleased that our high operational standards and social responsibility commitment that our bank has built over the years has attracted IFC confidence in our business model and sustainability. The loan will help us bolster Thai Credit's position, allowing us to better serve these underserved segments," said Roy Agustinus Gunara, Managing Director of Thai Credit.

IFC will also help Thai Credit develop financial products to serve WMSMEs as well as a Social Loan Framework, which is in line with internationally recognized social loan principles.

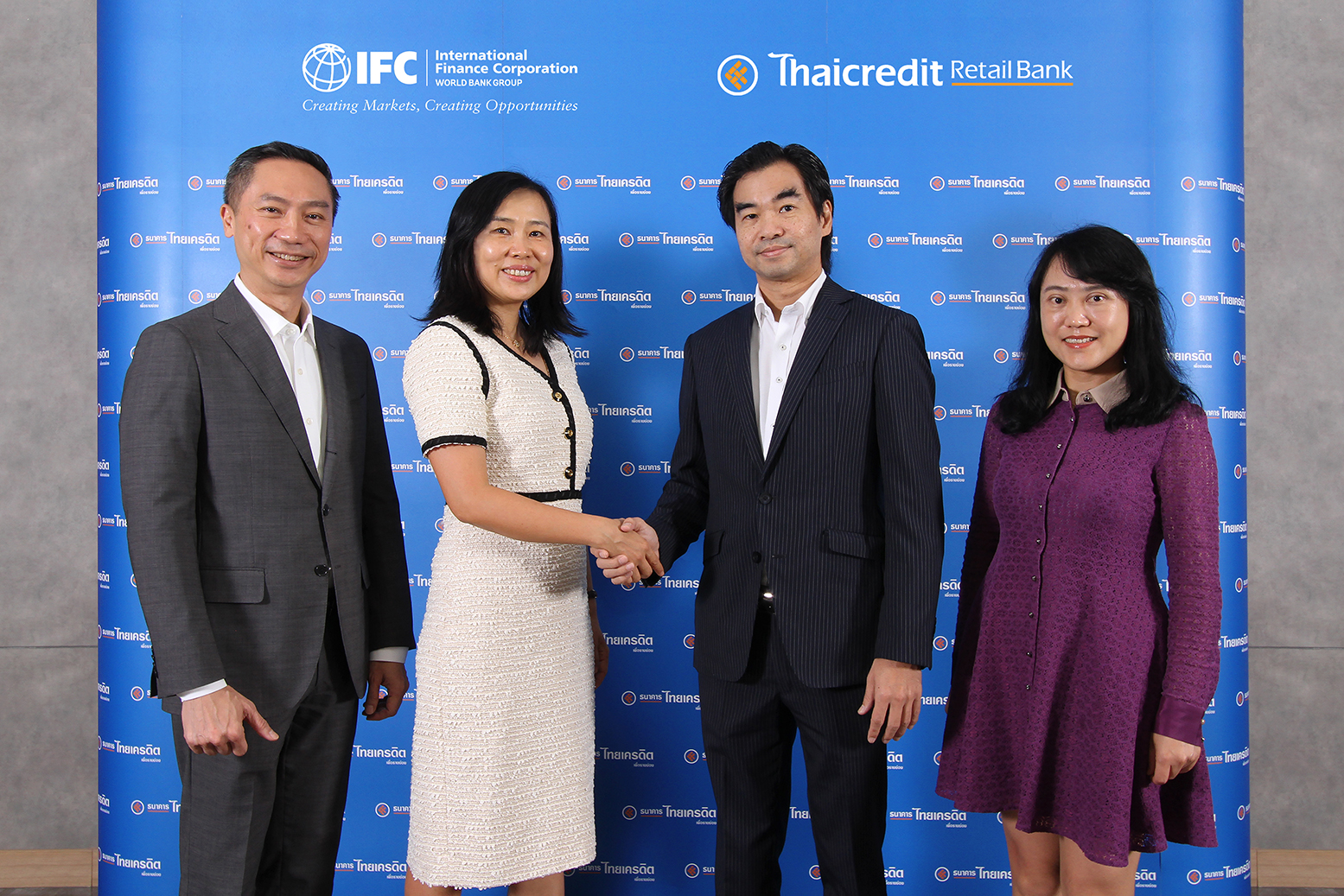

"Our partnership with Thai Credit is part of IFC's ongoing efforts to support inclusive growth particularly for MSMEs, which remain a key growth engine for Thailand's economy despite being historically underserved," said Jane Yuan Xu, IFC's Country Manager for Thailand and Myanmar. "IFC hopes to help Thai Credit differentiate itself from other players, while creating opportunities for small businesses especially those owned by women."

For the past two decades, IFC has been at the forefront of promoting greater financial inclusion in Thailand by working with key partners in the financial sector. This project is part of IFC's systematic approach towards deepening Thailand's social financing market, supporting post-COVID sustainable and inclusive economic recovery, and addressing the financing gap for underserved MSMEs and WMSMEs.

About IFC

IFC—a member of the World Bank Group—is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2022, IFC committed a record $32.8 billion to private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity as economies grapple with the impacts of global compounding crises. For more information, visit www.ifc.org.

Stay Connected

www.ifc.org/eastasia

www.twitter.com/IFC_EAP

www.youtube.com/IFCvideocasts

www.ifc.org/SocialMediaIndex

www.instagram.com/ifc_org

www.facebook.com/IFCeap

www.linkedin.com/showcase/ifc-asiapacific

About Thai Credit

Thai Credit officially started to operate as a retail commercial bank on January 18, 2007. Thai Credit aims to be the best micro bank in Thailand serving the underserved by providing unique, simple and transparent financial products and services including micro-SME Kla Hai and micro finance products to mom and pop stores across its 500+ branches nationwide. Under the "Market Conduct" and "Responsible Lending" policies, Thai Credit is committed to provide financial access to small business owners in order to improve their business and quality of life.

Stay Connected

www.tcrbank.com

www.facebook.com/thaicreditofficial

www.youtube.com/@tcrbthailand

https://lin.ee/lhXu9nh

Contacts

Stay Informed

Sign up to have customizable news & updates sent to you.