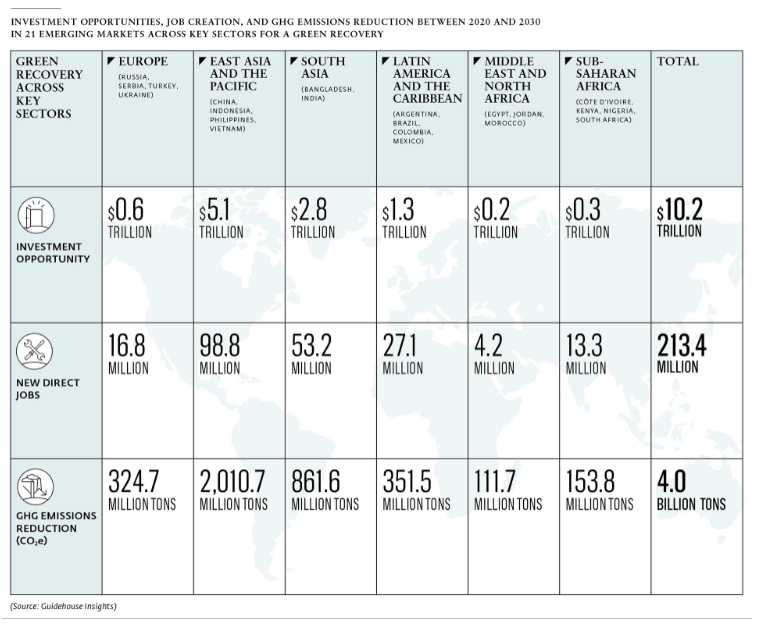

WASHINGTON, January 13, 2021—Supporting low carbon investments through COVID-19 recovery targeting funding for ten key sectors across 21 emerging markets has the potential to generate $10.2 trillion in investment opportunity, create 213 million jobs, and reduce greenhouse gas emissions by 4 billion tons by 2030, says an IFC report published today.

The report, Ctrl-Alt-Delete: A Green Reboot for Emerging Markets, analyzes the economic and climate benefits of a green recovery that focuses on decarbonizing existing and future energy infrastructure, building climate-smart cities, and helping speed the transition of key industries to greener production. It finds that rebuilding emerging and developing economies today to be greener tomorrow can not only drive economic recovery from COVID-19 but also help diminish the disproportionate impact of climate change on the world’s poorest and most vulnerable people.

The report highlights how investment in ten sectors through post-COVID recovery efforts can help to support deliver economic recovery, create jobs, and help achieve the goal of limiting global temperature rise to below 2 degrees Celsius.

The report, Ctrl-Alt-Delete: A Green Reboot for Emerging Markets, analyzes the economic and climate benefits of a green recovery that focuses on decarbonizing existing and future energy infrastructure, building climate-smart cities, and helping speed the transition of key industries to greener production. It finds that rebuilding emerging and developing economies today to be greener tomorrow can not only drive economic recovery from COVID-19 but also help diminish the disproportionate impact of climate change on the world’s poorest and most vulnerable people.

The report highlights how investment in ten sectors through post-COVID recovery efforts can help to support deliver economic recovery, create jobs, and help achieve the goal of limiting global temperature rise to below 2 degrees Celsius.

The report draws on lessons learned from IFC’s own investments and mobilization of private capital for climate business. As the largest development finance institution supporting the private sector in emerging markets, IFC has experience creating and growing markets in key areas such as clean energy, sustainable cities, climate-smart agriculture, energy efficiency, green buildings, and green finance.

Thirty percent of IFC’s total committed and mobilized investments were in climate business in FY20, representing $6.8 billion. The World Bank Group has adopted a target for 35% of its financing to have climate co-benefits, on average, over the next five years. IFC catalyzes markets for climate business through advisory services to businesses, financial institutions, and governments. IFC proactively works to create a global market for green investments to increase climate lending through capital markets and local financial intermediaries.

The report is available at: http://wrld.bg/cLTA30rnSEF.

Thirty percent of IFC’s total committed and mobilized investments were in climate business in FY20, representing $6.8 billion. The World Bank Group has adopted a target for 35% of its financing to have climate co-benefits, on average, over the next five years. IFC catalyzes markets for climate business through advisory services to businesses, financial institutions, and governments. IFC proactively works to create a global market for green investments to increase climate lending through capital markets and local financial intermediaries.

The report is available at: http://wrld.bg/cLTA30rnSEF.

About IFC

IFC—a member of the World Bank Group—is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2020, we invested $22 billion in private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity. For more information, visit www.ifc.org.

IFC—a member of the World Bank Group—is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2020, we invested $22 billion in private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity. For more information, visit www.ifc.org.

Stay Connected

Contacts

Stay Informed

Sign up to have customizable news & updates sent to you.