Dar es Salaam, Tanzania, June 25, 2021— A number of financial institutions in Tanzania were found to be performing well regarding gender equality at senior management levels, though gender gaps remain and more could be done to improve the position of women in the country's private sector, according to an IFC study published today.

The study, Leading Women in Tanzania's Financial Services Sector, explores several issues related to gender, including parental leave policies, corporate leadership plans, perceptions about recruitment, retention, and promotion, as well as bullying and harassment.

For example, just 39 percent of the women surveyed believed there is pay parity, compared with 63 percent of men, suggesting the need for transparency and clarity about compensation policies.

The study collected data from five large companies, in addition to a survey of 196 employees in 12 separate companies. It also features inspiring stories of 22 women leaders in Tanzania's financial sector.

"Giving women equal opportunity to become leaders in the financial sector is not only the right thing to do, it is also good for business. IFC champions gender equality in the private sector and this report shows how corporate leaders in Tanzania can better support women in senior roles and ensure equal opportunity for women," said Jumoke Jagun-Dokunmu, IFC's Regional Director for Eastern Africa.

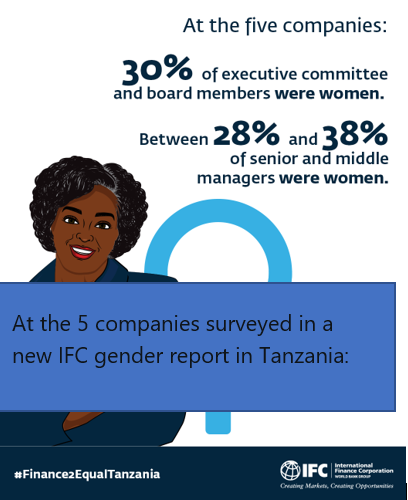

The report also found that 30 percent of the executive committee and board members in the five companies surveyed were women. While the number is above the regional average of 12.7 percent, Tanzania still trails regional peers such as Kenya, South Africa, and Rwanda according to Boardroom Africa.

It urges CEOs and board members to champion the business case for gender-inclusive leadership, set targets, and hold management accountable for implementing gender-smart strategies.

Suggested measures include establishing a clear accountability mechanism for the number of women in senior leadership positions, growing the talent pipeline for women leaders, and ensuring women serve as role models.

IFC's Finance2Equal Tanzania Gender and Financial Inclusion program was launched in 2019, and works with select companies to reduce gender gaps in the financial sector through research, peer learning, and firm-level support. Under the initiative, the study investigates gaps in workplace policies and practices and differences in women's and men's roles, making recommendations to reduce gender gaps. The program is working with NMB Bank, CRDB Bank, Standard Chartered Bank, TPB Bank and Sanlam Life Insurance as peer learning partners for gender equality. NMB Bank is also the lead private sector partner for the initiative.

The study can be found here.

About IFC

IFC—a member of the World Bank Group—is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2020, we invested $22 billion in private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity. For more information, visit www.ifc.org

Stay Connected

Contacts

Stay Informed

Sign up to have customizable news & updates sent to you.