Summary

Download Report

Based on nearly 40 years of data collected by the International Finance Corporation (IFC), this report offers a comprehensive analysis of default rates for the IFC corporate loan portfolio. It provides information potentially useful to understand credit performance in emerging markets.

The report presents aggregate default rates as well as variations observed across different parameters such as industry, region, and country income group. Using a more limited data set, since 2017, the report shows default rates by IFC’s internal credit risk rating.

Over the period from 1986 to 2023, the IFC's portfolio exhibited a default rate of 4.1%. The highest historical default rates were observed in 1986 and 2003, reaching 11.5% and 10.3%, respectively. The analysis reveals that the manufacturing, agribusiness, and services industry group exhibited the highest default rates, followed by infrastructure, and financial institutions.

Looking at the split of default rates across World Bank regions, Africa exhibited a rate of 6.7%, driven primarily by investments in the earlier part of the observation period, while all other regions ranged between 3.2% and 4.5%. Looking at the data by country income group, lowincome economies exhibit the highest default rates, with 8.6%. Based on a more limited data set, from 2017, annual default rates show, generally, the expected correlation with risk rating.

The first sections provide technical details about the methodology and the composition of the underlying data. The following sections present default rates and insights across relevant dimensions.

- Emerging markets can be perceived as risky

- GEMs can help change that perception

- GEMs can help reduce the gap between perceived and real risks

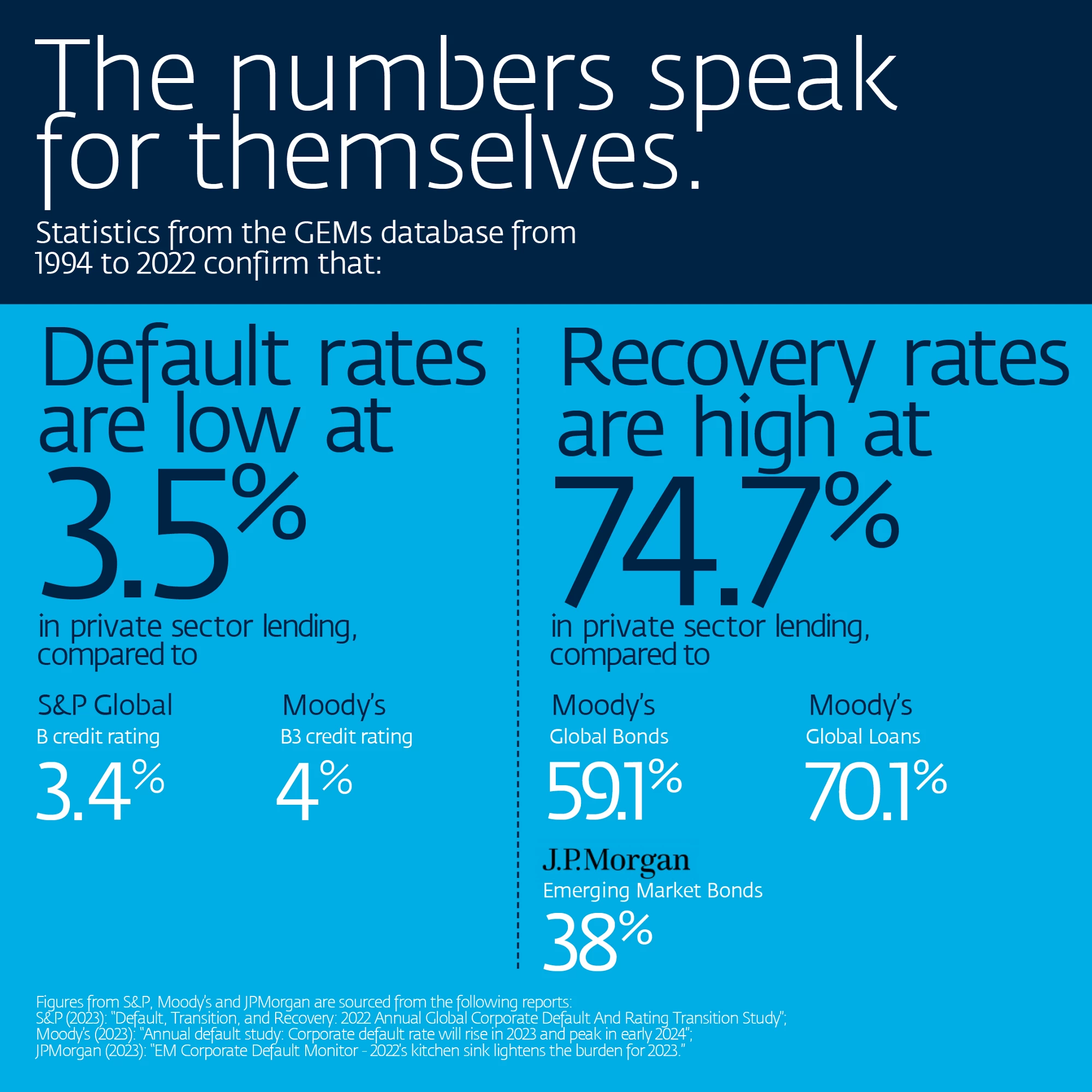

- Statistics from the GEMs database

- World Bank Group's new statistics from private sector lending

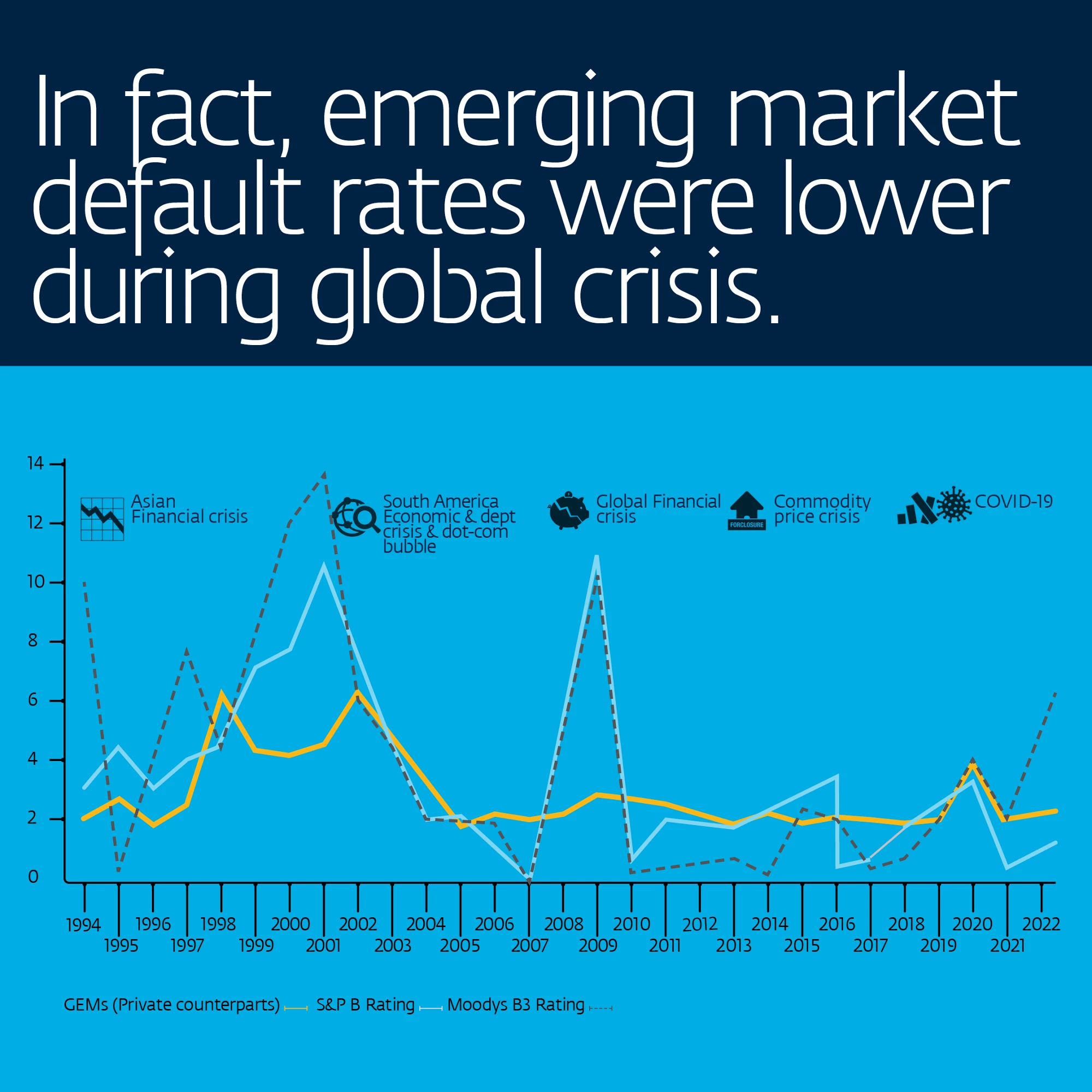

- Emerging market default rates were lower during global crisis