By Gary Seidman

The days of smokestack economies are slowly winding down. As evidence of climate change mounts and governments take urgent action to avert irreparable damage to the planet, some believe that Africa’s economies are poised to embark on a period of greener industrialization that could accelerate their development.

“There’s a huge opportunity to build green and adopt new technology that could help Africa transition to higher-value production without inflicting the kind of environmental damage we’ve seen from manufacturing in the past,” said Susan Lund, IFC’s vice president for economics and private sector development.

Historically, manufacturing has put countries on a fast track to middle- and high-income economies. The Asian Tigers, with modern economies barely 50 years old, now rank among the most industrialized countries on the planet. Their dynamism has created 2.2 billion of the world’s 4 billion middle-class consumers who account for 40 percent of global consumer spending.

In the next 20 to 30 years, Africa’s manufacturing sector is expected to double in size. The African Union’s Agenda 2063 — its blueprint for development — envisions transforming the continent from an exporter of raw materials into a sophisticated production center that utilizes its own resources to manufacture locally, generate new wealth, create jobs, and lift living standards.

Outside of extractive industries such as mining and oil drilling, however, Africa currently has very little manufacturing infrastructure to speak of. Most will have to be built from scratch. By harnessing the continent’s wind and solar resources and adopting new renewable technologies such as battery storage (which relies on the continent’s rich cobalt reserves), Africa “has a significant opportunity to leapfrog more developed nations and build a thriving low carbon manufacturing sector from the ground up,” according to a new report from the consulting firm McKinsey.

Nobody has any allusions that this will happen overnight, or that it will be cheap, but the incentive for green growth in Africa is compelling. Besides being particularly vulnerable to global warming — which is predicted to worsen water shortages and food insecurity in the region — Africa’s population is projected to double in the next 30 years. By 2050, a quarter of the world’s people will live on the continent. By 2100, 40 percent of the world will be there.

That growth trajectory is already driving rapid urbanization, spawning large concentrations of young middle-class consumers, and attracting the attention of global brands that are on the lookout for the next big consumer market.

“Africa is definitely going to be industrialized,” said John Anagnostou, senior industry advisor at IFC. “The only question is who’s going to do it and when will it happen.”

A new prescription for growth

Since the First Industrial Revolution, a period from 1760 to 1840, manufacturing and integration into global value chains has been the prescription for achieving rapid economic growth and creating jobs.

In the 1960s, the “Asian Miracle” started with labor-intensive textile and apparel manufacturing. Asian economies dug themselves out of post-war poverty and progressively adopted more complex technologies to produce higher value goods they could sell on global markets. As their fortunes grew, the “miracle” economies invested in education, technology, infrastructure, and improving living standards.

The spark, of course, was the region’s large workforce that could manufacture goods cheaper than European or American workers. Combined with investments in technology, progressive trade policies, investment incentives, subsidies, special economic zones, and transportation innovations such as the modern cargo container, the region exploited that competitive advantage to become the factory to the world.

Times are considerably different now. “Development is not following the same orderly path that we saw in East Asia over the decades,” Lund said. Today’s mechanized factories mean there may soon be less need for large pools of low-wage workers. That’s a concern for Africa, where the working-age population is predicted to grow by nearly 70 percent to 450 million by 2035.

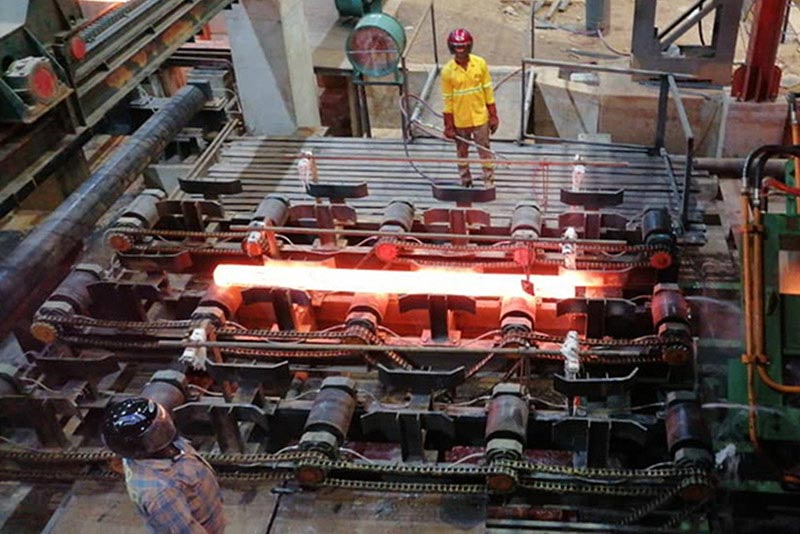

Investments will help train more manufacturing workers in Africa. Photo courtesy: Rider Steel

One school of thought argues that AI (Artificial Intelligence), robotics, and modern global trade is making it cheaper, easier, and greener to use automation — rather than low-skilled workers — to manufacture goods. Some economists contend that developing countries are beginning to eschew industrialization altogether.

Lund disagrees. “We think that the concept of premature deindustrialization is probably premature,” she said. The latest data seem to concur with her point. A November 2020 World Bank report said that although Africa “experienced an increase in manufacturing employment, from a total of 8.6 million in 1990 to 21.3 million in 2018,” the growth was dominated by low-skill jobs.

“Labor is cheap in Africa, but attracting trained and skilled workers is a challenge,” said Walid AlAlami, CEO of Rider Steel Industries in Ghana. “Even simple stuff like welders, electricians, and mechanics are difficult to find,” he said, adding that investments are needed to train workers to become more technically savvy.

Sabine Schlorke, the former head of IFC’s Global Manufacturing division, said African economies have indeed made progress integrating into global manufacturing value chains, “but they’ve done it primarily by exporting raw materials and importing processed materials. They can import cheaply and at scale, but that doesn’t help them develop higher skilled and higher paid workforces, and the capabilities that manufacturing economies require to grow wealthier and more complex.”

Basically, said Lund, “Digging things out of the ground or chopping them down and exporting them is not having a lot of value added for Africa’s economies. But some companies are starting to seize opportunities to move into commodity processing.”

Attracting trained and skilled workers can be a challenge. Photo courtesy: Wemy Industries

The COVID-19 effect

Supply chain disruptions due to COVID-19 and vaccine scarcity (most COVID-19 vaccines initially went to richer countries) were reminders of just how vulnerable import-dependent economies can become, said Paul Adedoyin Odunaiya, CEO of Wemy Industries, a Nigerian healthcare products manufacturer.

Businesses, he said, responded by “localizing supply chains to resolve these shortages and high import prices.”

“We must be more self-reliant,” Amadou Hott, Senegal’s economy minister, told The Economist. In October 2021, Senegal and Rwanda signed an agreement with Germany’s BioNTech, which developed the Pfizer-BioNTech vaccine, to manufacture RNA vaccines in Africa. This is “crucial for transferring knowledge and know-how, bringing in new jobs and skills, and ultimately strengthening Africa’s health security,” said Matshidiso Moeti of the World Health Organization.

The climate crisis may also provide an economic boost for Africa, which is rich in minerals such as cobalt and copper that are critical for producing the batteries necessary for transitioning economies away from fossil fuels to a cleaner, greener, electric future. Companies have been jockeying for control of cobalt reserves in the Democratic Republic of Congo, the origin of two-thirds of the world’s cobalt.

Economists say that to foster a culture of industrial development, African countries need to first upgrade infrastructure. The continent suffers from chronic electricity disruptions. Some 600 million people are not on the grid; internet connections are spotty, roads are pitted with potholes, and airports and ports need modernizing.

“We face daily challenges in moving our goods out and bringing raw materials in because of the road network,” said Rider Steel’s AlAlami. “Ports are unable to keep up with the amount of containers coming in and out, and most of the time we face huge delays getting our parts and equipment.”

Special Economic Zones backed by reliable infrastructure would go a long way toward generating employment and leveraging the trade advantages of the African Continental Free Trade Area, according to economists.

The good news is that Africa has a strong opportunity to build new greener infrastructure—though it won’t be cheap. McKinsey estimates that Africa will require $2 trillion of investment to replace or retrofit the region’s power sector and manufacturing facilities in a greener fashion.

First published in January 2022

Updated in June 2022