By Andrew Mayeda

The chaotic streets of Dhaka had gone strangely quiet. The government had imposed a national lockdown on March 26, 2020—Bangladesh’s Independence Day—ordering residents to stay indoors and shutting down public transportation. Hunkered down at a hotel with his management team, Waseem Alim was in a bind.

Alim’s business, Chaldal, had made impressive inroads delivering groceries through a web and mobile phone application. The people of Bangladesh were used to shopping at small stores and produce stalls, but they’d been warming to the idea of having fresh mangoes and other goods delivered to their door with a few swipes of their mobile phones. Flush with new financing, Chaldal had been looking to expand. Now, amid the worst pandemic in a century, nearly a third of its employees were unable to come to work because of lockdown restrictions. As firms around the country put their operations on hold, Alim was facing pressure inside the company to shut down the business.

But he couldn’t ignore a simple fact: orders for Chaldal deliveries were spiking. In fact, demand was so strong for some products that Chaldal had to ration essentials such as rice and cleaning supplies. Alim took a chance in keeping the business running, securing a permit from the government so the company’s bicycles, minivans, and motorbikes could continue making deliveries.

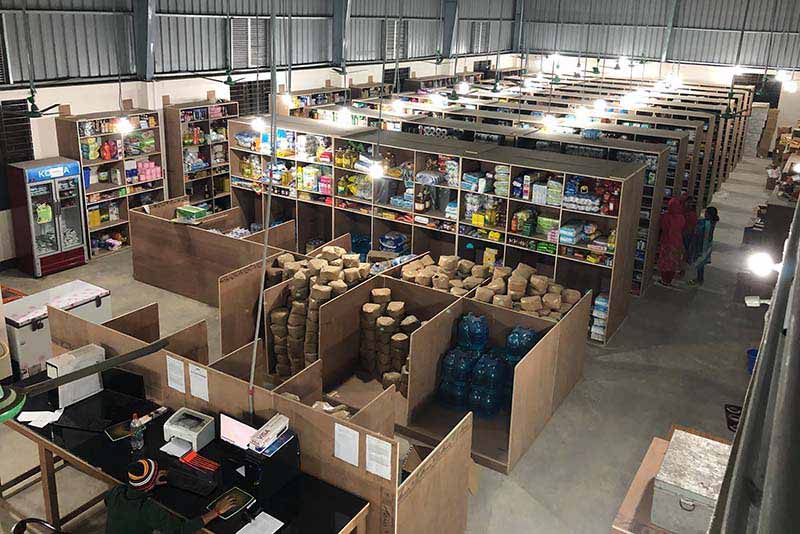

Chaldal’s sourcing warehouse in Dhaka. Photo courtesy: Chaldal

Today, more than 18 months into the pandemic, Chaldal has more than doubled its revenues, expanding its staff from 900 to 2,600 people. Alim is considering other business lines where Chaldal can expand, such as the delivery of medicines and other necessities.

Around the world, companies like Chaldal are looking to surf a wave of accelerated digital technology adoption that business leaders and policymakers hope could transform emerging markets and developing countries. A company called Fawry is helping Egyptian shopkeepers and their customers simplify the shopping experience through electronic payments. TradeDepot is supplying tens of thousands of small-scale retailers in Africa through its digital platform. And in Argentina, a company called Affluenta is expanding its peer-to-peer lending network.

By cutting out middlemen and allowing consumers to use mobile technology, Chaldal believes it has a competitive advantage in the fragmented retail supply landscape of Bangladesh, a country of 165 million people that’s celebrating its 50th birthday this year and aspires to be an upper-middle income country in the next decade.

Chaldal staff monitor the company’s logistics system at its facility in Dhaka. Photo courtesy: Chaldal

“We think we can play a very big role in consolidating the customer supply chain, providing more variety and quality to our customers,” said Alim, the company’s co-founder and CEO.

Globally, as countries imposed lockdowns and companies asked their employees to work from home, internet bandwidth usage around the world grew 38 percent, according to the International Telecommunications Union. McKinsey has described the acceleration in digital adoption by companies as a “quantum leap.” The average share of customer interactions that are digital, for example, jumped to 58 percent globally in July 2020, compared with 36 percent in December 2019, according to a survey by the consulting firm. The digital drive is impacting companies in a variety of ways, from pushing assets into the cloud to exploring ways to “reshore” production, replacing factories spread around the globe with domestic plants using robotics and automation.

An inflection point for emerging economies?

In developing countries, the challenge will be to ride the technology wave in a way that helps them emerge from the pandemic stronger. In the 1990s and early 2000s, emerging markets and developing economies had been the engine of global growth. But even before the pandemic, labor productivity was slowing.

Then came COVID-19. Firms that didn’t shut down were forced into semi-hibernation, sometimes propped up by government stimulus, loose monetary policy, and financing from international financial institutions. Investment took a major hit, plunging by 10.6 percent in emerging markets and developing economies (if China is excluded)—a much deeper hole than during the Great Recession. School disruptions have interrupted learning, undermining the accumulation of human capital. Economists expect the scars of the pandemic will run deep. Now, even as some advanced economies reopen, many developing countries are being battered by fresh waves of COVID-19 cases.

Emerging markets and developing economies are expected to grow 6 percent in 2021, according to a World Bank Group forecast issued in June, but the growth forecast is notably uneven across the developing world. In updated forecasts released in July, the International Monetary Fund warned that the outlook for emerging markets is darkening compared with advanced economies, with vaccine access acting as the main fault line.

But emerging markets and developing countries could re-establish themselves as dynamic forces in the global economy—if a technological virtual circle takes hold that boosts productivity. That optimistic scenario, according to World Bank Group economists, would require vaccination campaigns to proceed smoothly and policymakers to implement business-friendly reforms, including diversifying their economies away from over-reliance on commodities and tourism, and allowing resources to be shifted to more productive parts of the economy.

The digital surge could turn out to be a major inflection point in the history of development, said William Sonneborn, senior director of disruptive technologies at IFC. The growth of remote working, for example, could open opportunities for workers in developing countries to fill the needs of companies in advanced economies, stemming the “brain drain” that has often plagued poorer nations and helping them adopt a new development model based on skilled talent, he said.

The key, he believes, will be for governments to create a regulatory and tax environment that allows entrepreneurs to flourish. “It’s really about ease of setting up businesses and creating a risk-taking culture,” said Sonneborn. “What we need is for countries to avoid the tendency to tax at the early stage, when these businesses are losing money. If they’re patient and let the business become successful, then they can institute the right policies to recoup revenues for the government.”

Prioritizing digital connectivity

Policymakers in developing countries must balance the benefits of investing in digital connectivity with urgent needs in areas such as water, electricity, and health care, said Bogolo Kenewendo, Managing Director of Kenewendo Advisory and former minister of investment, trade, and industry in Botswana. Given the fiscal constraints many governments are facing, they will likely have to use public-private partnerships and other vehicles to crowd in private capital to invest in IT infrastructure, she said.

“Just two years ago, very few major businesses and governments wanted to engage in this conversation of digitization, mainly because it wasn’t seen as a priority,” said Kenewendo, referring to countries in Africa. “COVID has given everyone a kick to transform.”

In a country like Bangladesh, ongoing development of its digital infrastructure—and the skills of its people—will be key to the country’s fortunes. Buoyed by the strength of its ready-made garment sector, Bangladesh has been a development success story in recent decades. The rate of extreme poverty, defined as an income of less than $1.90 per day, fell from 43.5 percent in 1991 to 14.3 percent in 2016. Child mortality rates are falling, life expectancy is rising, and high-school enrollment for girls is on the rise.

But COVID-19 has hit hard in the garment sector, the nation’s biggest source of foreign exchange. Nearly half the population remains vulnerable to falling back into poverty. According to a Country Private Sector Diagnostic report released by IFC and the World Bank in June, the recovery will force a reimagining of the country’s development model, which previously relied on the relatively low labor costs. It will be critical for the government to introduce a new round of reforms to strengthen and modernize the private sector, which in recent years had become increasingly concentrated and inward looking, according to the report.

More investments in digital infrastructure will be important to Bangladesh’s efforts to build a more open, competitive private sector. Large capital investments are needed to build up high-quality digital infrastructure, including fiber-optic backbone, 4G capacity and telecom towers, the report said.

Digital banking grows quickly

A digital push could spawn more successes like bKash Ltd., which has been offering mobile payment services to its customers since 2014. The service quickly proved popular in Bangladesh’s traditionally cash-based economy. Mobile money has been a key driver of financial inclusion in the country, expanding the share of the population with access to financial accounts. Initially, when opening a bKash account, new customers would visit a bKash agent who checked their identification and set up an electronic wallet. Now customers can just scan their national ID and enroll from the app directly. They can also add money to their e-wallets by depositing cash at an agent, through remittances and other payments, or by transferring money from their bank account.

Since the pandemic, accounts have only continued to grow, reaching 54 million accounts as of July 2021. The service has literally become a lifeline during the crisis. The government has been using bKash and Nagad, another mobile financial services company, to distribute social safety-net allowances. bKash, a subsidiary of BRAC Bank Ltd., launched in 2010 and received a $10 million investment from IFC in 2013. Other investors include the Bill & Melinda Gates Foundation and Ant Financial.

“It was fundamentally designed for the unbanked,” said Kamal Quadir, CEO of bKash. “Today it’s become a universal platform.”

New forms of banking are also gaining traction in the Philippines. BPI Direct BanKo is the financial inclusion arm of Bank of the Philippine Islands, the country’s oldest bank. Since 2016, BanKo has been making microfinance loans to entrepreneurs, many of whom were previously borrowing from informal lenders. From an initial pilot of four branches, the service expanded to 307 branches. The pandemic has persuaded the company to further modernize its credit scoring model and develop new products under which the lending process would be mostly digitized, said Jerome Minglana, President of BPI Direct BanKo Inc. Under an advisory deal with IFC, the company is working to achieve those goals.

A client of BanKo, Ms. Joan Laguardia at her business. Photo by: Abeson Argosino/BanKo

“What the pandemic has done is it’s now challenging us to look for alternative ways to serve the customers without necessarily putting up brick and mortar branches,” said Minglana.

The digital wave is also hitting other parts of the developing world, including Latin America. Venture capital is plowing into the region at a rate outpacing the global average, according to data provided by Mountain Nazca, a venture-capital firm based in Mexico City that invests in early-stage startups in Latin America. The region is likely still early in its digital transformation, with promising opportunities in sectors such as fintech, e-commerce and clean tech, said Jaime Zunzunegui, managing partner at Mountain Nazca.

“The transformation is happening now and you have to be a part of it,” Zunzunegui said, echoing many of his peers from other parts of the world.

Ahsan Z Khan, an IFC communications officer in Dhaka, contributed to this story.

Published in September 2021